The reality of the wage gap and its backgrounds

Screenshot youtube.com

Screenshot youtube.com

The fact that women still earn significantly less than men in the world of work is still ubiquitous today and is difficult to deny. This income difference is manifested in particular by the fact that women are rarely represented in the better-paid sectors and management positions. Even if women do the same activities as their male colleaguesexercise, they often get a lower salary. This imbalance is a major question of justice, the causes of which are more complex than it may seem at first glance. It is by no means exclusively a result of a targeted disadvantage by patriarchal structures, but also a mixture of social expectations,individual life decisions and deeply rooted behavioral patterns. Conscious and unconscious preferences, personal priorities and social imprints make a significant contribution to women choosing different paths than men in their career development.

social influence and personal life strategies

On average, women are considered to be particularly socially competent, strong in communication and focused on interpersonal relationships. They are often described as less money-oriented, which is reflected in the decision for certain professional fields. For example, many women choose to work in the social, educational or nursing field, which are sociallyrecognized as important, but are remunerated significantly less financially. In addition, women often work part-time or take longer professional breaks to take care of the upbringing of their children or the care of relatives. These decision patterns are not only an expression of social expectations, but also the result of conscious life strategies. in return forMany women are not the focus of money, but rather the opportunity to shape relationships and actively enrich their own social environment. Money is thus less understood as a status symbol and rather as a tool to increase the quality of life.

The decreasing marginal utility of money from a female point of view

For numerous women, money does not have the same status as for many men. While men often see their financial success as a sign of status and power, the benefits of money in everyday life and in lifestyle are often crucial for women. As soon as a certain level of financial security is reached, many women no longer have the desire for everhigher incomes, but rather the need to invest time and energy in relationships, family and self-realization. Experience shows that women get to the point where additional money does not bring any further comfort in life, but on the contrary can even reduce the quality of life, for example through more stress, less time and greater commitments. However, that meansNot that women are generally less ambitious or willing to perform, but that they set different standards for a fulfilling life.

Retirement provision and financial independence – an underestimated challenge

Especially with regard to old-age provision, the lower income of women is a central problem. After a separation or divorce, many women face the danger of becoming financially disadvantaged or even poor in old age. It is therefore of great importance that women provide early-stage financial security and not focus on the care provided by their partner.leave This includes more than a separate bank account or assets. It is also important to have an active say in questions of wealth formation, budget planning and real estate financing and to insist on equality within the partnership. It is not uncommon for real estate to be entered on the man’s name, while the woman bears the financial responsibility – aConstellation, which can lead to significant disadvantages in the event of a separation of property. Women should therefore legally insure themselves and pay attention to their legitimate claims instead of waiver of rights from misunderstood loyalty.

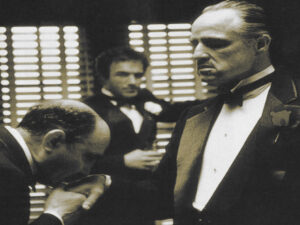

Traditional role patterns and the male financial world

The ideas and images of money are deeply rooted in language, culture and social structures. In most cultures, power, status and prosperity are closely linked to male attributes. The image of the successful man who proudly talks about his fortune and appears in public as a financial expert is firmly anchored in pop culture. especially inThe upper hierarchical levels of the financial industry are dominated by men who perform with self-confidence, suit and traditional values. These structures form the last bastion of patriarchal power relations and are also reflected in the internal processes and decision-making processes. Personal experiences show that there are still men who deal with the topic of money as a purely male affairand want to exclude women from this area. At the same time, many women continue to take on other tasks within the partnership and delegate the financial responsibility to the man – often out of the belief that he is more competent or experienced.

The danger of incapacity and the importance of active participation

This behavior leads to a creeping incapacity, in which women are increasingly withdrawing from the topic of money and letting their male partner take control. Especially younger couples show that this pattern does not decrease, but is even reinforced in some cases. Many women hope that the supposedly unpleasant topic of finance will be on their ownis taken, which, however, leads to dependence in the long term and impairs one’s own self-determination. But there are also numerous counterexamples: women who take on the role of the chief financial officer in the partnership and have the last word in all important decisions. Such role models show that it is possible to actively shape your own financial affairs andnot to rely on traditional role models.

Financial formation, risk aversion and the role of financial advice

A central problem remains the lack of financial formation. Studies show that women are more afraid of contact when it comes to investing, securities and investments than men. This starts with the basic terms: Many women hardly know what a fund or share is and show a lower interest in economic issues overall. The pronounced risk aversion often leadsIn addition, security in the investment is of top priority, while the willingness to take risks for higher returns remains low. This in turn means that women invest less in high-yield investments and achieve lower yields in the long term, although their caution would actually be particularly suitable for low-risk strategies. Many financial service providers haveThese differences are recognized and offer special offers for women, but these are often based on clichéd assumptions and serve more the commission business than real support.

New ways: self-determination, role models and changes in structures

Despite all the existing hurdles, there are numerous women who are committed to their financial independence and inspire others. In the world of financial blogs, podcasts and coaching, more and more women are campaigning to make financial topics understandable and accessible. They pass on their knowledge, encourage others to take personal responsibility and break down prejudices. friendPersonalities like Dani Parthum, who speaks about financial topics as a “money woman” about financial topics, impressively show how women can take their finances into their own hands and thus become role models for a new generation. However, there is still a lot to do to fundamentally change the structures and strengthen the financial self-determination of women. This not only requires better education andInformation, but also a rethinking in society and the willingness to question traditional role models.

More self-confidence and participation for a fairer future

In order to overcome the financial inequality between women and men, a holistic approach is needed that takes into account individual decisions as well as social structures. Women should be encouraged to actively deal with their finances, to educate themselves and to take on responsibility. This is the only way to be able to self-determine your own path in lifeto create and set the course for a self-confident and secure future. Money should be viewed not only as a means to an end, but as a tool for shaping a fulfilled life – for women and men alike.