Tax waste: underestimated wound in the state budget

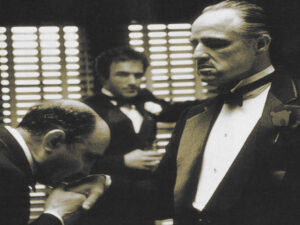

Screenshot youtube.com

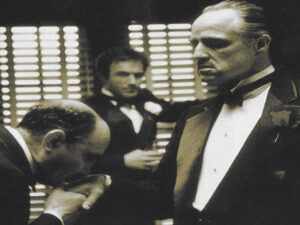

Screenshot youtube.com

The debate about waste of taxes is as old as the modern tax system itself, but it has never been more relevant than it is today. Public funds flow into projects whose usefulness is often incomprehensible. Authorities and politicians spend money on prestige objects, promotional events and expensive infrastructure projects, although sustainable economic benefits oftenis not recognizable. The criticism of the taxpayers’ association makes it clear how numerous authorities handle taxpayers carefree. New examples are constantly appearing in the “Black Book” every year – a transparency register for public waste that calls into question the allocation of funds and becomes a reminder for politics and administration.

The cognitive dissonance among officials

In everyday life, many officials feel that the measures, investments and projects they have implemented often do not meet the actual needs of the citizens. Internally, it is known that there is no real benefit for many expenses, but the mechanism continues. The cognitive dissonance manifests itself as inner turmoil: the knowledge of wastedTax money collides with professional routine and specifications of the superiors. However, the discomfort is rarely expressed openly, since the structures offer false incentives and individual criticism is easily lost in the bureaucratic process.

Infidelity and lack of consequences

Tax waste is punishable in applicable law and may be punished as breach of trust under applicable regulations. However, the multitude of examples from political practice makes it clear that these regulations are hardly applied. The legislative is formally limited by the separation of powers, in reality a system in which bypass mechanisms is createdFantasy projects and household economies too often arise from the legal and moral guidelines. The fear that tax waste must be prosecuted in a similar rigorous manner as tax evasion has so far remained a pious wish and not practiced practice.

Useless household titles and lack of control

The criticism is aimed in particular at budget items such as development aid, questionable funding from non-governmental organizations or constantly increasing EU membership fees, the connection of which often does not exist with the reality of the citizens of citizens. The allocation of funds is based on questionable logical and political criteria, while much-needed investments ininfrastructure, education and social security are often neglected. Rule of law deletions of these budget titles have so far been in short supply; The political will to consistently control and sanction is lacking.

High tax burden and lack of thrift

The tax and tax burden in Germany is one of the highest in Europe. The trust of the population would grow if state authorities learn to get along with the money they have made available to them. Instead, new debts are constantly being taken up, the interest burden is increasing and the burden on future generations is increasing. Citizens are increasingly getting the impression that the administrationdoes not deal with the available resources economically and responsibly, but rather legitimizes itself through ever new expenses and oversized projects.

Loss of trust as a permanent state

The consequences are serious: Trust in state institutions is dwindling, citizens are experiencing an increasing distance to administration and the political elite. The taxpayers’ admonitions and the countless negative examples from all regions and administrative levels show a state that has too often said goodbye to efficiency and thrift. Those who pay high taxes expectA responsible use of the funds – but the scandals about public waste regularly prove the opposite. The loss of trust thus becomes a permanent social state.