Creation of money – an approach to the exploration of the monetary system

Screenshot youtube.com

Screenshot youtube.com

Anyone who attempts to establish their own monetary system will eventually be confronted with state authority. The state has a monopoly on the monetary system, and it insists on it. In contemporary economies, this monopoly is transferred to the respective central bank, with the basic principle unchanged. The central bank is responsible for theProvision of funds (and thus also for the emergence of debts). But that’s not the end of it, because now the banking department comes into play.

Legal tender: cash and book money

Legal tender is made up of cash and book money. Cash can be issued in the form of banknotes only by the central bank or – in a limited context – by states (coins). When newspaper reports speak of the “note press”, this actually refers to an increase in cash circulation. However, the proverbial printing press is oftenfor the increase in cash and book money, although the book money is now the far more important aspect.

The role of banks in money creation

This is where the banks come into play. They too are able to create book money. This is very uncomplicated. Book money is omnipresent. The salary has long since ceased to be paid out in the form of payslips, but appears as an excerpt on a bank statement or in an online banking application. We also make most of our expenses cashless, be it throughGirocard or credit card. Cash payment is no longer common on the Internet.

Trust and the importance of cash

Although the book money is of great importance to us and we use it regularly, we never want to give up cash entirely. First of all, many prefer not to pay for their two rolls with a credit card at the bakery, and secondly, the “feeling” certainly plays a role: we want to physically experience the value of the money and ensure at any timecan that our ATM will issue Euro notes when we need them. Here, too, the aspect of trust comes into play again. Ultimately, a book money system can only work if there is trust.

Creation of book money through loans

Book money is created by granting loans. For example, if the X-Bank grants Meier a loan of 50,000 euros and provides this amount as credit on a loan account, this will lead to growth in the book money. Once book money has been created, it circulates continuously.

The cycle of money in the credit process

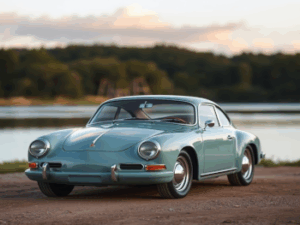

Suppose Mr Meier needs the loan to buy a car. The money will then be transferred to the account of the car dealership of his choice. His house bank is happy about the receipt of payment. If the money is available to her for a longer period of time, she can “work” with it and invest it in securities or grant another loan. additional lending or the offsetting of theCash flows from the securities purchases mean that at some point fresh money will be received by bank X by bank transfer. In this way, book money is the fuel that banks need for their business.

The potential of money creation and reserve regulations

The potential for money creation in the banking system through loans is enormous. However, it is limited by the minimum reserve. The European Central Bank requires all euro area credit institutions to deposit a certain percentage of customer deposits in a central bank account. This share is therefore not available for further lending. so-calledMoney creation multiplier provides information about the potential for increasing the money of our banking system.

Calculation of the money creation multiplier

This is determined by dividing the number 100 by the minimum reserve set. With a minimum reserve rate of 1 percent, the multiplier is 100; If this rises to 2 percent, a multiplier of 50 and so on is obtained. The levers for money creation decrease drastically with increasing reserve reserve rates. At 10 percent minimum reserve, the factor falls with a value of10 relatively low. The banking system can thus “only” increase the money supply by tenfold.

Benefits of a low reserve reserve

How advantageous for the banking system is that the minimum reserve rate is currently only 1 percent. Theoretically, the money supply could be increased a hundredfold. This represents – even if you consider that this is a mathematical maximum value that is never fully achieved in practice – an enormous potential for improvement. Therefore, one of thenumerous proposals to contain the problems in the financial sector also a significant increase in the reserve reserve rate.

Consequences of an increase in the reserve reserve rate

In extreme cases, a reserve rate of 100 percent would completely prevent the potential to create book money by banks. The money creation multiplier would then be 1; There is nothing more to increase. The bank would only be able to work with the money that is actually available to it – similar to any other company it must. This would be for thebanks extremely unfavorable. In their eyes, this would be tantamount to an annihilation of money.