Vintage cars as a sustainable and emotional capital investment

Screenshot youtube.com

Screenshot youtube.com

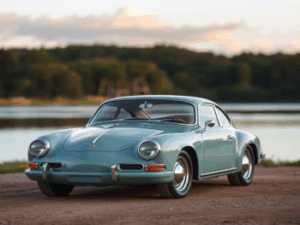

Oldtimers are characterized not only by their nostalgic value, but also by their limited availability and the often increasing demand in certain collector’s circles. These factors can lead to selected models gaining value over the years and thus represent an interesting alternative to classic investment forms. However, it should be noted that theMarket for historical vehicles requires special knowledge and is significantly influenced by individual preferences and the condition of the vehicle.

Personal preferences of classic cars beyond performance

In addition to the purely financial aspect, personal passion often plays a decisive role when investing in vintage cars. Many collectors appreciate the aesthetics, history and feeling associated with the possession and preservation of a classic vehicle. This emotional commitment means that the choice of a classic car is often not only based on itsvalue enhancement, but also according to individual preferences such as brand, model, year of manufacture or origin. Thus, the investment in vintage cars becomes a combination of investment and hobby, which further increases the appeal of this special form of investment.

Criteria for choosing an investment worthy vintage car

When choosing a vintage car as an investment, various criteria must be taken into account that have a significant impact on the later value and the development opportunities. First of all, the rarity of the model plays a central role: vehicles with a limited production number or special special editions are often more popular and therefore more stable in value. Equally important is the state of preservation, becauseOriginal or professionally restored vehicles achieve significantly higher prices on the market than copies that are in need of repair. The history of the vehicle, including complete documentation and comprehensible previous owners, can strengthen the trust of potential buyers and thus increase the value. In addition, factors such as the brand and the year of manufacture also have an influence on theAttractiveness of a classic car as an investment object. Models from renowned manufacturers with cult status or from particularly important production years are often more in demand. After all, the personal interest and expertise of the investor should not be ignored when choosing, since this knowledge can be decisive in acquisition, care and sale.