Gold as an investment: How to protect yourself from rising prices

Screenshot youtube.com

Screenshot youtube.com

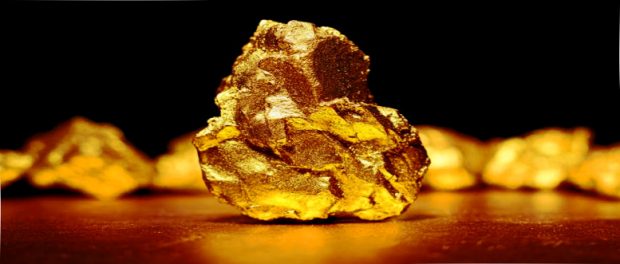

Imagine you want to protect your assets from rising prices. So why can gold be considered a safe investment? Whether it is better to invest in gold coins or gold bars. Discover the long-term benefits of gold as a hedge against inflation.

The importance of gold as a safe investment

Gold has always had a special meaning as a safe investment. In uncertain times or in economic turbulence, the precious metal is often seen as a safe haven that can protect against the effects of rising prices. The long-term stability of gold prices makes it an attractive option for investors who want to secure their assets. Whether in the form of gold coins orGold bars, the decision for which type of gold investment is made, often depends on individual preferences. While gold coins may be preferred due to their smaller size and higher liquidity, gold bars may provide better long-term protection against inflation due to their higher purity. Ultimately, it is important to have personalGoals and individual risk tolerance when choosing between gold coins and gold bars.

Protection against rising prices with gold

If you want to protect yourself from rising prices, you often rely on gold as a safe investment. Gold has proven itself over the years as a stable value holder and can therefore offer effective protection against inflation. Unlike other forms of investment, such as stocks or real estate, gold reacts less volatile to economic fluctuations and retains its value in uncertaintimes. The physical presence of gold in the form of gold coins or gold bars allows investors to access their investment at any time and thus flexibly protect themselves against rising prices. The decision between gold coins and gold bars depends on individual preferences and investment goals, but gold generally remains a long-term option for securingprotect assets from the effects of inflation.

Gold coins or gold bars – what is the better choice?

The decision between gold coins and gold bars can be a difficult one when it comes to choosing the best form of gold as an investment. Gold coins are often popular because of their collector’s value, while gold bars usually have a lower surcharge and can therefore be purchased in large quantities more efficiently. When it comes to protecting yourself from rising prices, you canBoth options are a good choice. It ultimately depends on your individual preferences and goals. While gold coins are easier to trade and may be able to offer a higher return, gold bars are often more cost-efficient and easier to store. Regardless of your choice, it is important that you consider your investment in the long term to effectively fight inflationto secure. Gold has proven itself over the years as a solid hedging and can therefore play an important role in your portfolio.

Gold as a long-term hedge against inflation

With the constant threat of rising prices and inflation, it is crucial to have long-term security. Gold has proven to be a reliable investment over the centuries, which remains stable even in times of economic uncertainty. Unlike other forms of investment, Gold retains its value and can serve as protection against the effects of inflation. it isA crisis-proof investment that also endures in turbulent times. Gold coins or gold bars are the two main options, with the decision being dependent on individual preferences and goals. No matter what form of gold you choose, it provides a solid basis for long-term security and can help you to protect assets from the consequences ofto protect inflation.